Hanuman Water Token (HWT):

Hanuman Water Token (HWT):

The Contract with Earth that Redefines the Value of Crypto-Assets

Text by Uarian Ferreira

More than just code on a blockchain, the HWT is the materialization of a new paradigm: a digital contract with the Earth, which grants its holder the right of access to a real, vital, and purposeful asset: the Hanuman Water – Multimillennial Hyperthermal Multifunctional Mineral Water – Tritium-Free.

The HWT is the token of a rare, unique, and mineral-rich water that emerges at the Hanuman Deposit at 42 °C, with a pH between 7.5 and 8.1. This water has traveled more than 9,000 years of underground infiltration through the nearly 2-billion-year-old crystalline basement of the Chapada dos Veadeiros, one of the oldest rock formations on the planet, located in the Central Plateau of Brazil.

This article explores the legal and economic nature of the HWT as a utility token, differentiating it from collective fundraising models, such as crowdfunding, and purely speculative financial tokens.

The economic exploration model of Hanuman Water was conceived by the project’s creator based on four fundamental pillars: distributive, regenerative, inclusive, and sustainable. Official and constructive dialogue with the Brazilian Securities and Exchange Commission (CVM) allowed this structure to be refined and consolidated, confirming the utilitarian nature of the HWT and its alignment with the principles of the new economy.

Eighteen Years of Resilience Before Tokenization

The project that originated the Hanuman Water Token (HWT) began in 2007 and went through an eighteen-year cycle of geological research, environmental regeneration, and technical certification, combined with the observation of the cultural and social roots of the Chapada dos Veadeiros and the consolidation of mining rights over the Hanuman Deposit.

This territory, with almost 10,000 km² — an area equivalent to that of Jamaica — harbors a natural and human wealth intrinsically integrated into the proposed exploration model.

Tokenization is not the project itself, but the chosen way to democratize access to a natural resource whose exploration was planned to also generate opportunities for the local community, with technical rigor, transparency, and long-term socio-environmental responsibility.

HWT as a Utility Token: Real Access to a Unique Natural Asset

A utility token, by definition, grants its holders access to a product or service. The Hanuman Water Token is the purest expression of this concept. Each HWT represents the right of access to one liter of hyperthermal mineral water from the Hanuman Water Deposit, a resource with unique characteristics on the planet.

The value of the HWT does not lie in the expectation of financial appreciation, but in its intrinsic utility. It is an asset that can be “delivered, manufactured, consumed, and celebrated,” a counterpoint to the lack of backing, volatility, and the purely speculative nature of many crypto-assets. The project does not promise or guarantee financial appreciation to holders but offers access to a scientifically validated and officially certified natural resource.

Differentiating from Crowdfunding and Refuting the Howey Test

Consulted by Hanuman Minas Ltda about the token model, the CVM, through Official Letter No. 18/2025/CVM/SSR/GRID (PAd n.19957.005518/2025-25), raised the possibility of the HWT being classified as a Collective Investment Contract (CIC), applying the so-called Howey Test.

PAd n.19957.005518/2025-25

The analysis is based on two pillars: the expectation of profit and the effort of third parties as a determining factor for this profitability.

Concrete Industrial Demand vs. Expectation of Profit

The main evidence of the HWT’s utility is the concrete and quantified demand from the industry. Companies in the cosmetics and floral remedies sectors of the Chapada dos Veadeiros have already requested a long-term supply commitment, totaling 2.4 million liters of Hanuman Water. These companies do not seek the HWT as an investment but as an essential productive input for their operations, as highlighted in the response letter to the CVM:

This demand is concrete and based on experimental tests that proved the superior quality of the water, demonstrating that the token grants access to a resource with proven utilitarian value, not a promise of financial return.

Intrinsic Value vs. Effort of Third Parties

The value of Hanuman Water does not depend on a future business effort by Hanuman Minas to generate it. It resides in its intrinsic properties, already validated and certified. SINDIFARGO (Union of Pharmaceutical Industries in the State of Goiás) recognized the quality of the mining asset, officially proposing to the State the organization of the artisanal cosmeceutical sector in the Chapada dos Veadeiros.

The HWT functions as a mechanism for accessing a resource that already has proven utilitarian value. The project’s success is linked to the intrinsic utility of the resource and the demand for access to the productive input, not to promises of business effort that generate financial return for token holders.

Fundamental Difference: HWT vs. Crowdfunding vs. Speculative Tokens

The legal and economic nature of the HWT clearly distinguishes it from two models frequently confused in the universe of digital assets: collective fundraising contracts (crowdfunding) and speculative financial tokens.

HWT is not Crowdfunding

In a crowdfunding model, investors contribute resources with the expectation of future financial return, depending on the success of the venture and the effort of the entrepreneurs. The HWT, conversely, neither promises nor generates an expectation of profit. It grants a right of access to an already existing physical resource that is validated and has proven demand.

The offer of 100 million tokens, corresponding to 100 million liters of water, represents only 20.6% of the authorized annual production of the Hanuman I Well/Spring, which has an authorized annual production and capture capacity of 485,000 m³. This conservative proportion demonstrates that the project prioritizes the preservation of the resource over the maximization of revenue, a characteristic incompatible with the logic of collective fundraising aimed at financial return.

Furthermore, the allocation of 6% of the tokens to be freely distributed to the local community and the OSCIP Pulsar Vida demonstrates an intrinsically social economic model focused on territorial development, not on generating profit for investors.

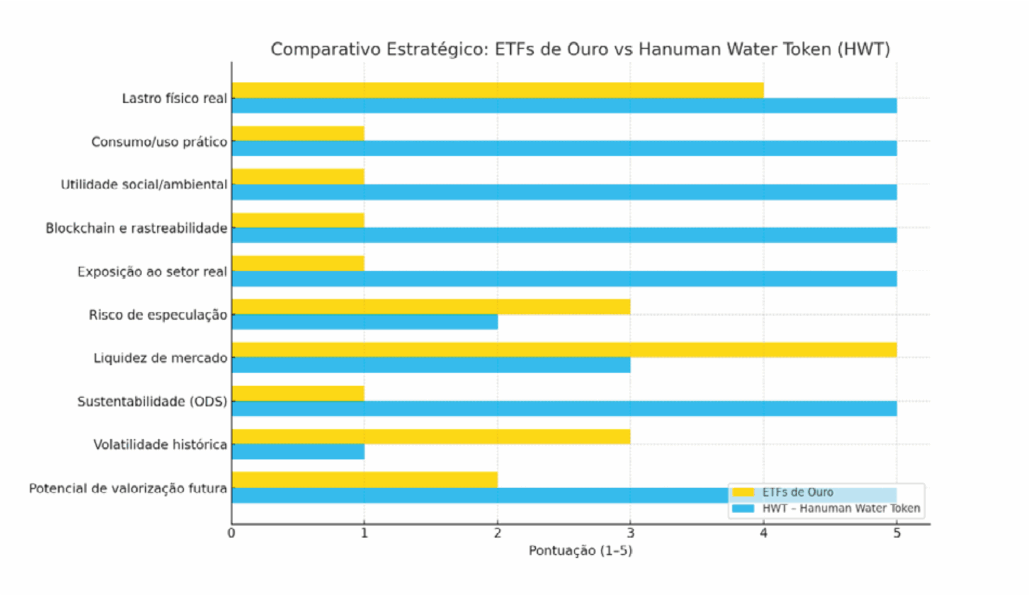

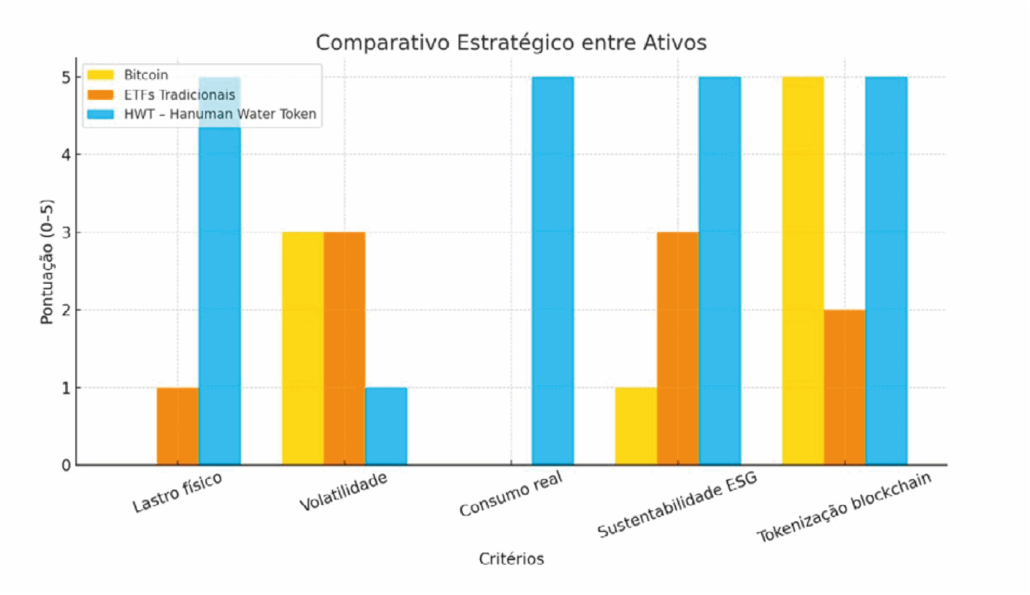

HWT is not a Speculative Token

Speculative tokens, like many cryptocurrencies, are acquired with the expectation of appreciation in the secondary market, without physical backing or practical utility. The HWT, on the other hand, has a 1:1 relationship with a tangible physical asset: each token represents the right to redeem one liter of hyperthermal mineral water.

The HWT is based on the intrinsic utility of the resource and the demand for access to the productive input, not on promises of financial return. The secondary market, if it exists, will naturally reflect the dynamics between the limited supply of a scarce resource and the demand for its proven utility, but the project neither promises nor guarantees appreciation to holders.

Table of Differences: Crowdfunding, Speculative Token, and HWT

| Characteristic | Crowdfunding | Speculative Token | HWT (Utility Token) |

| Holder’s Objective | Financial return | Market appreciation | Access to a physical resource |

| Value Basis | Future business effort | Market speculation | Intrinsic, validated properties |

| Backing | Business promise | None or abstract | Physical (1 token = 1 liter of Hanuman Water) |

| Validation | Financial projections | Market volatility | Experimental tests + industrial demand |

| Purpose | Profit for investors | Capital gain | Practical utility (consumption, manufacture, services) |

| Economic Model | Concentrative | Speculative | Distributive, regenerative, inclusive, and sustainable |

Economic Exploration Model of the Asset: Distributive, Regenerative, Inclusive, and Sustainable

The HWT was conceived with an economic architecture that distances it from the logic of collective investment. Its four pillars form the basis of a new economy.

The distributive pillar is exemplified by the allocation of 6% of the total tokens (6 million HWT) to be freely distributed, with 3% for the local community of Chapada dos Veadeiros and 3% for the OSCIP Pulsar Vida. This initiative represents the world’s first basic income in cryptocurrency backed by a natural resource, an anti-speculative mechanism that promotes territorial development and demonstrates the project’s social character.

Strategic Distribution of Tokens

The distribution of the 100 million HWT tokens balances public access and sustainable development: 80% allocated for public distribution; 6% for the development team; 5% for the Operational Reserve Fund (guaranteeing liquidity for water redemption); 3% for strategic partnerships; 3% as rewards to the local community; and 3% for consultants and marketing. This transparent structure reflects the project’s distributive, regenerative, inclusive, and sustainable economic model.

The Four Pillars of the Economic Exploration Model of the Hanuman Water Deposit

| Pillar | Description | Impact on HWT |

| Distributive | Distribution of part of the tokens to the local community and social partners. | Reduces concentration and speculation, promoting social development. |

| Regenerative | Reinvestment in the conservation of the Chapada dos Veadeiros ecosystem. | Guarantees the perpetuity of the resource and environmental balance. |

| Inclusive | Participation of the community in the governance and benefits of the project. | Empowers local actors, transforming them into protagonists. |

| Sustainable | Prioritization of resource preservation over revenue maximization. | Ensures the availability of water for future generations. |

First Pre-Sale: Benefits and Priorities for the Hanuman Ecosystem

The inaugural offer aims to sell the public offering of 80 million liters of water (equivalent to 80 million tokens) in 12 months. The Hanuman Water Token (HWT) has a price of US$ 2 per liter.

This first pre-sale grants pioneer participants exclusive benefits and priorities in the Hanuman Water ecosystem, including priority redemption during periods of high demand, preference in future new token offerings from the Water Deposit and its Wells/Springs, exclusive discounts on ecosystem products and services, and participation in the founding community with access to special events. This structure recognizes and rewards those who believe in the proposed economic model for the commercial exploration of the Hanuman Water Deposit from the beginning.

Natural World Asset (NWA): The Future of Tokenization

The HWT inaugurates a new category of digital assets: the Natural World Asset (NWA). Unlike Real World Assets (RWAs), which often limit themselves to tokenizing real estate or financial assets, the NWA prioritizes utility, conservation, and social impact.

It is a “digital contract with the Earth” that represents a planetary, ecological, and civilizational vision, where digital assets are commitments to the preservation of the living system. The HWT materializes this concept by linking each token to one liter of hyperthermal mineral water, setting a precedent for the responsible tokenization of natural resources.

HWT: Beyond Code, the Connection with Life

The Hanuman Water Token is not just a digital asset; it is life, connected to the planet’s natural cycle. While almost all crypto-assets still face challenges like volatility and speculation, remaining restricted to digital abstraction, the HWT is a token with physical backing and real purpose.

The HWT transcends simple blockchain registration. It can be physically delivered, manufactured, consumed, and celebrated. It travels the world in contracts with the Earth, not confined to digital networks.

The HWT enjoys the highest privileges that nature and ethics confer on life. It is a contract backed by the purity of the multimillennial water emerging at the Hanuman Water Deposit, tracked by blockchain technology.

The HWT scientifically relies on the nanofilters of the nearly 2-billion-year-old crystalline basement of the Chapada dos Veadeiros. Inviolable in its origin and indestructible in its vital vocation, it is a natural asset with unique characteristics certified by independent institutions.

Deep Alchemy: Science and Spirituality

The HWT does not just have value; it has purpose, delivery, and impact. It is the deep alchemy of nature, rhythm, vibration, and transmutation, connecting science and spirituality.

The Hanuman Water Token grants real access to Hanuman Water, a resource with the potential to subtle and singularize the human body — a perfect and self-determined biocircuit — in tune with the pure and stable frequencies that sustain the coherence of quantum technologies.

Conclusion: The Era of Authenticity

The HWT is proof that blockchain technology can serve a greater purpose, connecting the digital world to a vital physical asset with real and inestimable value.

By clearly differentiating itself from a collective investment contract and a speculative token, the HWT sets a precedent for the management of natural resources, combining technological innovation with social and environmental responsibility. It is the vanguard of a movement that seeks more than profit, it seeks meaning.

The HWT represents access to a scarce natural resource, with certified unique properties, proven industrial demand, and a limited supply to a conservative fraction of the productive capacity. These fundamentals establish a solid foundation for a sustainable ecosystem, where practical utility and social impact are the central pillars.

As I wrote in an article paraphrasing the “Contracts with the Earth,” “Bitcoin was the revolution; the HWT is the evolution.” An evolution that takes us back to the essence, to what is real, tangible, and vital. The HWT inaugurates the Era of Authenticity.

The unique characteristics of Hanuman Water – hyperthermality, multimillennial perpetuity, and multifunctionality for human consumption, functional beverages, integrative medical therapies, cosmeceutical production, and thermal spray and technology applications – can be explored, including scientific certifications, on the institutional website www.hanumanwater.com and the token acquisition portal www.hanumanwatertoken.com.

______________________

(*) Uarian Ferreira – Idealizador e sócio administrador da Hanuman Minas Ltda, titular dos direitos minerários e superficiária da Jazida e Poço/Fonte da Água Hanuman.

Link para Whitepaper HWT (Out/2025):